Unlocking the Secrets of Universal Basic Income: A Financial Equilibrium Perspective

In a groundbreaking research paper authored by Kim Weston from Rutgers University, the author delves into the implications of Universal Basic Income (UBI) on financial equilibrium, offering insights into how this income redistribution policy could reshape both labor market dynamics and financial markets.

Understanding Universal Basic Income

Universal Basic Income (UBI) is a proposed economic policy in which all citizens receive a regular, unconditional sum of money from the government, regardless of their other income. The primary goal of UBI is to alleviate poverty, encourage economic stability, and provide a safety net for individuals in the face of economic uncertainty and technological automation.

Key Insights from the Research

Weston's research presents a model that demonstrates how a financial equilibrium can be achieved under a UBI scheme, where economic agents—individuals participating in the economy—make decisions about work, consumption, and investment based on perceived incomes that include UBI.

Two significant findings from the model include:

- Labor Market Participation: The study reveals that while increasing UBI can lead to decreased labor market participation based on certain conditions, it can also foster higher participation when perceived positively. This dual effect emphasizes the nuanced and contextual nature of worker incentives when guaranteed income is introduced.

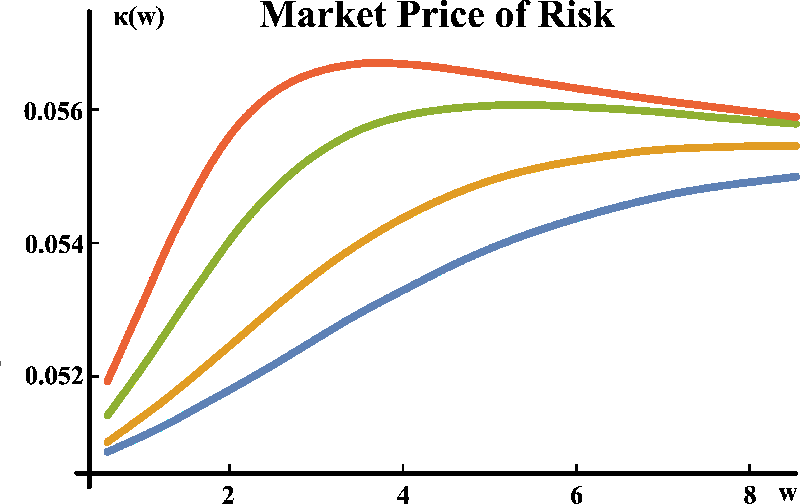

- Impact on Financial Markets: The paper identifies that the effects of UBI on the stock market are complex and non-linear. It challenges conventional wisdom that would suggest straightforward outcomes; instead, Weston shows that the response of financial markets to UBI can be unpredictable, varying with individual perceptions and economic responses.

The Methodology Behind the Model

Weston's model uses a mathematical framework involving backward stochastic differential equations (BSDEs) to predict how agents within the economy optimize their labor participation and investment strategies. By integrating individual perceptions into this model, Weston emphasizes how economic agents do not just respond to their own conditions but also consider the actions and perceived responses of others around them.

Socialism vs. Communism: A Comparative Analysis

A particularly intriguing aspect of the research is its exploration of economic comparisons between socialism and communism under UBI. The results suggest that perceived incomes can substantially influence labor participation rates, thereby impacting total income generated within an economy. The implications of these findings set the stage for deeper discussions on the effectiveness of UBI in different political and economic systems.

Conclusion: Rethinking Economic Policy

Weston's findings significantly contribute to the ongoing debate about UBI's viability as a policy tool for addressing inequality and economic disparity. As societies grapple with the challenges of poverty and the changing nature of work, understanding the intricate relationships between income redistribution, labor participation, and financial markets will be crucial for informed policymaking. The comprehensive analysis provided in this study underscores the importance of incorporating complex financial interactions into discussions surrounding universal basic income.

With this work, Weston paves the way for future research and practical applications of UBI in real-world scenarios, encouraging policymakers to consider both the intended and unintended consequences of such economic interventions.

Author: Kim Weston (Rutgers University)